Which Waterloo Region companies made the 2020 Deloitte Technology Fast 500?

Note: this post has been updated with more info since initial publication

It’s a big day in the North American tech company landscape, with the publication of the 2020 edition of the Deloitte Technology Fast 500 list.

No doubt there will be lots of press releases and blog posts flying around today, so what’s one more? I thought I’d dive into the numbers a little bit to see how local companies (and companies with strong ties to the Waterloo Region) fared.

Here’s a teaser (we’ll come back to this chart later)…

But first, let’s start with some context to set the mood.

If you’re interested in more local deep-dives, then be sure to check out Waterloo EDC’s post: Waterloo companies take top two spots on Deloitte Technology Fast 50 (which is a different list with similar-but-different criteria that reveal up and comers)

What is the Deloitte Technology Fast 500 list?

For those who aren’t familiar (and I’m quoting directly from the 2020 PDF):

Technology Fast 500 provides a ranking of the fastest-growing technology, media, telecommunications, life sciences, and energy tech companies—both public and private—in North America. The 2020 Technology Fast 500 award winners are selected based on percentage fiscal year revenue growth during the period from 2016 to 2020.

In order to be eligible for Technology Fast 500 recognition, companies must own proprietary intellectual property or proprietary technology and it must be sold to customers in products or services that contribute to a majority of the company’s operating revenues. Companies must have base-year operating revenues of at least $50,000 USD, and current-year operating revenues of at least $5 million USD. Additionally, companies must be in business for a minimum of four years and be headquartered within North America.

The Fast 500 web page also clarifies that winners are, “selected based on percentage fiscal-year growth over a three-year period.”

So being included in the list is kind of a big deal.

[Update] Oh, and note also that companies aren’t automatically included—they have to apply. Not everyone does, of course. Plus, if in a particular year a company expects they might fall off the list, then they might decide it’s not worth it…even though it might have turned out that they would have stayed on.

Getting on the list is hard. Staying on it is harder.

To get on the list, a company needs to grow very rapidly, which is hard.

To stay on the list for a few years, a company needs to sustain a rapid growth rate even as the company’s baseline revenue increases, which is considerably harder for at least two reasons:

- You can have impressive absolute revenue growth while still experiencing a flat, declining, or just not super-high growth rate…the bigger you are, the more additional revenue you have to bring in to stay on the list

- An awful lot can happen over time that’s beyond your control—economic swings, hype cycles, increased competition, pandemics, and other factors

To bring these realities to life, I did some EXCEPTIONALLY TEDIOUS* number crunching over the last six reports (2015 through 2020).

*Involving manually transcribing 1,000 company names, using OCR from screenies to get another 500, and (blessedly) being able to copy and paste the other 1,500. Oh, then I had to manually search for variations on company names, because folks like to change it up from year to year (dropping an “Inc.”, changing the spacing, etc.). So, there may be a few human (me) errors here and there, but certainly not enough to change any of the findings. But I digress.

So what did I find? In the last six years:

- Fewer than 1,700 companies have been named to the list at least once…in other words, the ~3,000 (I found some mistakes!) entries represent 1,700 unique entrants

- For a little more than half (around 850) of those companies, a singular appearance across six years is all they achieved—here’s your drink ticket, thanks for coming out!

- Fewer than 500, less than 30 percent, made the list in any two of the six years (note that it’s MUCH more common for a company to be named in consecutive years than to have a gap between inclusions)

- Fewer than 200, about 11 percent, were named to the list in any three of the years

- Around 90, just over 5 percent, earned inclusion in any four of the years

- Fewer than 50, about 2.6 percent, made the list in any five of the six years

And only a tiny fraction—nine companies by my count—in the 2020 list were included for each of the last six years.

For you visual learners, here’s the distribution.

OK, back to the Waterloo Region

[Update: Originally this section only went back six years (2015 through 2020) but because I’m a nerd I went back as far as could and redid it. I was only able to get the lists going back to 2009, but hey, better than nothing.]

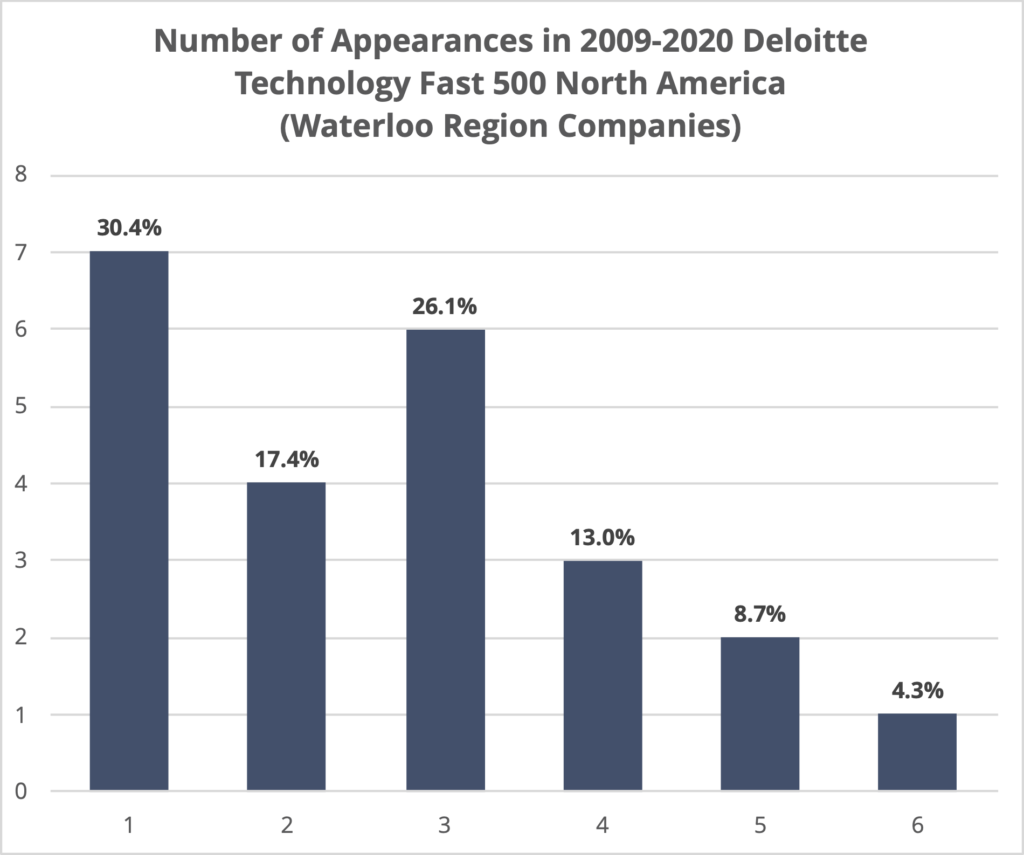

By my count, 23 companies with headquarters or meaningful presence in the Waterloo Region appeared in at least one of the last 12 editions of the Deloitte Technology Fast 500 (North America).

[Update: Originally the tables below were HTML tables, but that became a PITA when I expanded them…so now they’re just images (sorry)]

Rankings over the past 12 Deloitte Technology Fast 500 reports

Growth rates over the past 12 Deloitte Technology Fast 500 reports

Visually, we can see the number of companies with:

- One inclusion in the last 12 years (7): ApplyBoard, Smile.io, Athena Software, Clearpath, PEER Group, Desire2Learn, RTI Cryogenics

- Two inclusions (4): Auvik Networks, Arctic Wolf, TextNow, Aimetis

- Three inclusions (6): Sortable, Aeryon Labs, Magnet Forensics, Dejero, Miovision, Sandvine, ARISE Technologies

- Four inclusions (3): Vidyard, Axonify, Aeryon Labs

- Five inclusions (2): Igloo Software, BlackBerry

- Six (!) inclusions (1): eSentire

Here’s the distribution, nerds.

A few quick notes and observations…

Research in Motion / RIM / BlackBerry was amazing. AMAZING!!!

Look, I know BlackBerry stirs up lots of emotion: they were amazing, then they sorta collapsed, now they’re a security company, and so on…But let’s take a moment to recognize just how amazing their run on the Deloitte Fast 500 was.

In the chart at the beginning of this post, we just see the tail end of BlackBerry’s glory days, but here’s something we don’t see because I don’t have the data: according to this article, in 2008 BlackBerry (then RIM) was ranked #141, and it was their ninth straight inclusion.

Nine plus five equals FOURTEEN CONSECUTIVE YEARS ON THIS LIST. Think about the math, think about just how big RIM was at the time, and then shudder in your recognition of how astounding an achievement this was.

eSentire is remarkable

Recall earlier when I wrote that I only found nine companies (out of more than 1,650) who appeared in each of the past six Deloitte Technology Fast 500 lists?

Well, one of those is our very own eSentire. The scale of this achievement is remarkable and they’re rightfully proud.

In recent years we’ve had far more companies on the list

Just glance at the chart and you’ll see many more dots and lines on the right side than on the left. Maybe it just means that more Waterloo Region companies are applying for inclusion, or maybe it means our tech ecosystem is genuinely more populous and diverse than it was a decade ago.

Igloo had a really good run

Igloo had a five-year run from 2015 through 2019 that’s only just come to an end. Again, let’s pause and recognize that a five-year streak is rare, with fewer than 50 companies able to make that claim in the last six years.

Vidyard’s working on a streak of their own

Vidyard has a four-year streak going, dating back to 2017. It’s interesting to me that they didn’t debut until then (they were founded in 2011), given the disproportionate amount of attention they receive, but let’s not overlook the fact that a four-year streak is a terrific achievement.

Axonify also had a good run

Axonify had a four-year run from 2016 through 2019, before falling off this year’s list.

RTI Cryogenics reached #3

I’d never heard of RTI Cryogenics until doing this analysis, but back in 2011 they attained the third-place spot. There’s gotta be a story there, but I don’t know it.

What’s up with ARISE Technologies?

The name rings a bell, but I’m not familiar with them. They bucked the trend by landing on the list at #103 and then rising in consecutive years up to a peak of #19 in 2011—literally a month before succumbing to the solar industry bust and being delisted from the TSX.

What’s with all the downward trajectories? Is that bad?

I received a question/statement to the effect that the figure at the top of the post seems to show that the region’s companies are trending downward, which seems bad. Right?

Well, no. Keep in mind how this list is produced:

- It ranks companies by percentage fiscal year growth over a three year period

- The company must have had at least $50,000 in annual earnings at the start of the period

- The company must now be over $5,000,000 in annual earnings

These three factors combine to make it very likely that a company’s first appearance on the list will be the highest ranking they’ll ever achieve. And, as I’ve shown already, for literally most companies their first ranking will be their only ranking.

I didn’t plot the other ~1,630 or so companies (because holy crap), but if I had done so then the trajectories would almost all look very similar to what we see in the plot of the Waterloo Region’s companies.

Companies that land on the list and then improve their ranking in subsequent years are the exceptions. In Waterloo Region, we see three companies that achieved this feat in the last 12 years:

- BlackBerry: appeared on our list in at #160 before climbing to #144

- ARISE Technologies: appeared on our list at #103 before climbing in two straight years up to #19

- eSentire: debuted at #324, then climbed two years in a row to a peak of #247

- Igloo Software: debuted at #397, dipped as low as #451, then climbed two years in a row (an rare occurrence) to a peak of #392

- TextNow: debuted at 466 and jumped to #307 before dropping off

Who’s missing? Where’s so-and-so?

Here’s another question I received shortly after posting this, um, post: “Where are Kik and Thalmic/North?”

Frankly, I don’t think either company would have qualified.

I’d be genuinely surprised if Kik ever made $5M in a year selling stickers or ads (or whatever they did to generate revenue prior to breaking securities laws), but I’m not overly familiar with the company.

In Thalmic’s case, I’d be astounded if they sold enough Myo armbands to qualify. In North’s case, I think it’s generally well-known by now that they didn’t sell nearly enough Focals to qualify.

The argument could be made that Kik’s biggest achievement was getting a remarkably substantial speculative investment that skyrocketed their valuation, Thalmic’s biggest achievement was cashing in on the wearables hype to the tune of a whoppingly huge investment, and North’s biggest achievement was some very impressive engineering in a product very few people wanted.

The region has a number of successful companies, a fair crop of promising up-and-comers, and more interesting concepts in the very early stages than one can easily count—but articles and coverage tend to favour a select few.

Maybe as a region we can all take a moment to recognize a few things:

- hype and success are different, and the former does not cause the latter

- we hype up too many companies that are undeserving (or continue to hype them when the opportunity has passed or we’ve learned better), and we overlook too many genuine success stories that are better illustrations of what it takes to build a sustainable business; at the same time, we fail to raise awareness of the emerging generation

- (and maybe most importantly, because it’s at the foundation of lots of issues) valid critiques are not sacrilegious and that a Pollyanna “everything is awesome!” attitude is counterproductive

Oh, and on the topic of “who’s missing,” I only included companies with headquarters in the Waterloo Region or with “substantial operations” (my words):

- Arctic Wolf has about a third of their company here, and the other companies I examined all officially list Kitchener, Cambridge, or Waterloo as the location of their HQ

- “Substantial operations” is admittedly very fuzzy; Waterloo EDC‘s Fast 50 analysis, for instance, includes Tulip, but mine doesn’t (for what it’s worth, they’ve made the Fast 500 each of the last two years)

Feel free to ping me to nominate some other local companies, but if you do so then please give me an explanation as to why you think they meet the “substantial operations” requirement =)

Some other tidbits

Here are a few other bits and bites:

- The highest rankings attained by Waterloo Region companies in any of the last 12 years are: #3 (RTI Cryogenics in 2011), #9 (Dejero in 2014), #12 (Auvik Networks in 2019), and #14 (ApplyBoard this year and Aeryon Labs in 2014)

- The highest reported growth rates by Waterloo Region companies in any of the last 12 years are: 46278% (RTI Cryogenics in 2011), 14299% (Dejero in 2014), 12581% (ApplyBoard this year), 10670% (Aeryon Labs in 2014), and 10017% (ARISE Technologies in 2011)

- On 19 occasions in the last 12 years, Waterloo Region companies reported growth rates above 1,000%

- The most Waterloo Region companies included in any of the last six years is nine, in 2016

- Aeryon Labs and Aimetis are the only Waterloo Region companies to experience a gap year—recall that it’s very rare that a company returns after dropping off the list

- A number of regional mainstays (Magnet Forensics, Dejero, Miovision, Sortable, TextNow) had really solid showings in the 2013 to 2018 period, but staying on this list is damn tough